It is said that in this world, nothing can be certain, except death and taxes... and bills.

Take this for instance: regardless of how bothersome bill payments can be, many of us strive to get to them on time. If you've ever forgotten to pay a bill — electricity, DSTV, etc. especially on a weekend, you know how frustrating it can be and how quickly it can mess up your plans.

In the past, bill payments meant showing up at a physical location where you'd most likely end up in a long and tiring and probably hot waiting room for longer than necessary. But with the revolution that is online payments, sorting your bills has become less of a daunting chore 🎉

While it's undeniably true that the internet has made paying bills significantly easier, online payments don't stop you from forgetting a one-off or recurring bill— a risk that could potentially crumble vision for your bank account.

Scary, Is there a way out?

With gomoney? Always

One of our promises to you is to design products that fit into your lifestyle while making your life easier, by giving services you're already familiar with a design and efficiency makeover! With this promise at the back of our mind, we created Schedule payments— a feature crafted to assist you in organising your payments, make budgeting less frustrating and to free your time (and in some cases, your money) up for the things your enjoy.

One step closer to financial clarity 💚

What is a Scheduled Payment?

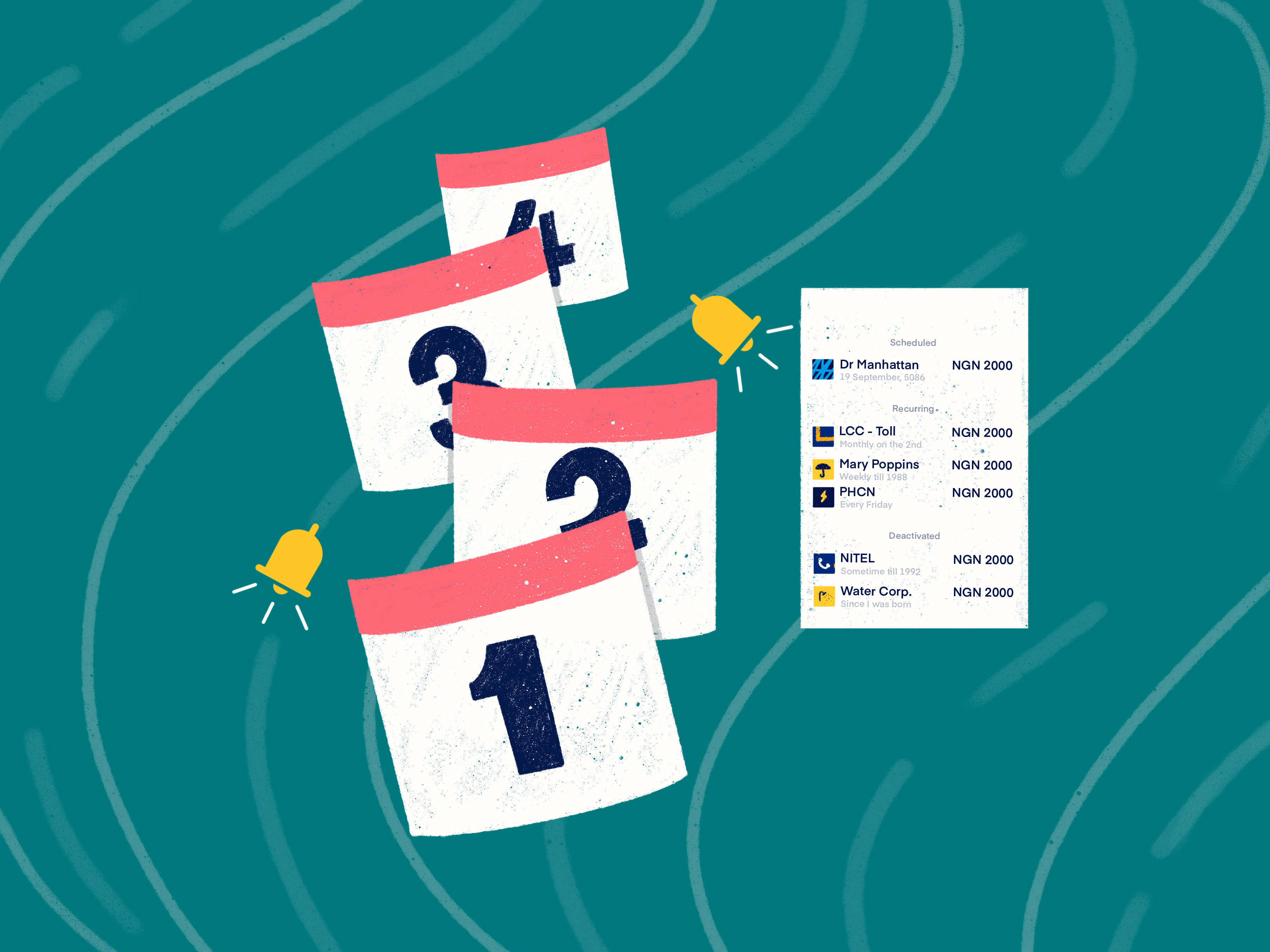

gomoney's Scheduled Payment feature comes in handy when you want to create a low-effort-high-reward bill payment strategy. It allows you to pay bills and make transfers from your gomoney account before the due date, so you can get it out of the way and focus your mind on other things.

Whether it's a recurring payment like your gym membership, pocket money or salaries, or a one-off like your yearly rent, all you need to do is set up the payments and schedule them from your gomoney app. On the indicated dates, we'll pay on your behalf.

Awesome. And cost?

For you? Nothing!

Asides the transaction charges that accompany some gomoney in-app purchases, there is no cost to set up a scheduled payment. There are also no fines for payment cancellation due to insufficient funds: if a payment can't be made because you don't have enough funds in your gomoney account, you will get a notification to fund your account and can carry on with your payment as usual.

Are there any limits?

With limitless banking? Never

There are no limits on how many payments you can schedule. Aside gomoney's regular payment limits, where your transaction limit is based on gomoney tiers, you're free to have as many as you want. To cancel a scheduled payment, select the payment you'd like to terminate and click 'Cancel'.

What is the best way to use this feature?

If you have any future payments coming up, especially those that can't be late, the Scheduled payments feature is the best way to go. We recommend documenting your payments- with the due date, amount and vendor's account details- then scheduling them on gomoney in that order. It's an excellent way to knock a monthly tasks off your chores for a long time.

Nice! And how does it work?

Once you log on to your gomoney app, tap ‘Payments’, followed by 'Scheduled payments’ and then 'Add New Scheduled Payment’. You’ll be asked to enter the vendor’s details, the date of payment and payment frequency. You can also schedule bills while you're paying them. That’s faster and more convenient.

Bonus tip: If you want something— like a nice watch— but can't afford it in one payment, ask the vendor if they allow payments in instalments. If they do, set up a scheduled payment structure that works for you (with their approval, naturally)

We'd like to get to know you! But let's start with a proper introduction 🤝

Or you can download the gomoney app here.